How Flexible Financing Is Changing the Early-Stage Startup Landscape

Not every startup is ready for priced equity rounds. And in today’s capital-conscious environment, more founders are turning to convertible notes and SAFEs to buy time, extend runway, and preserve optionality.

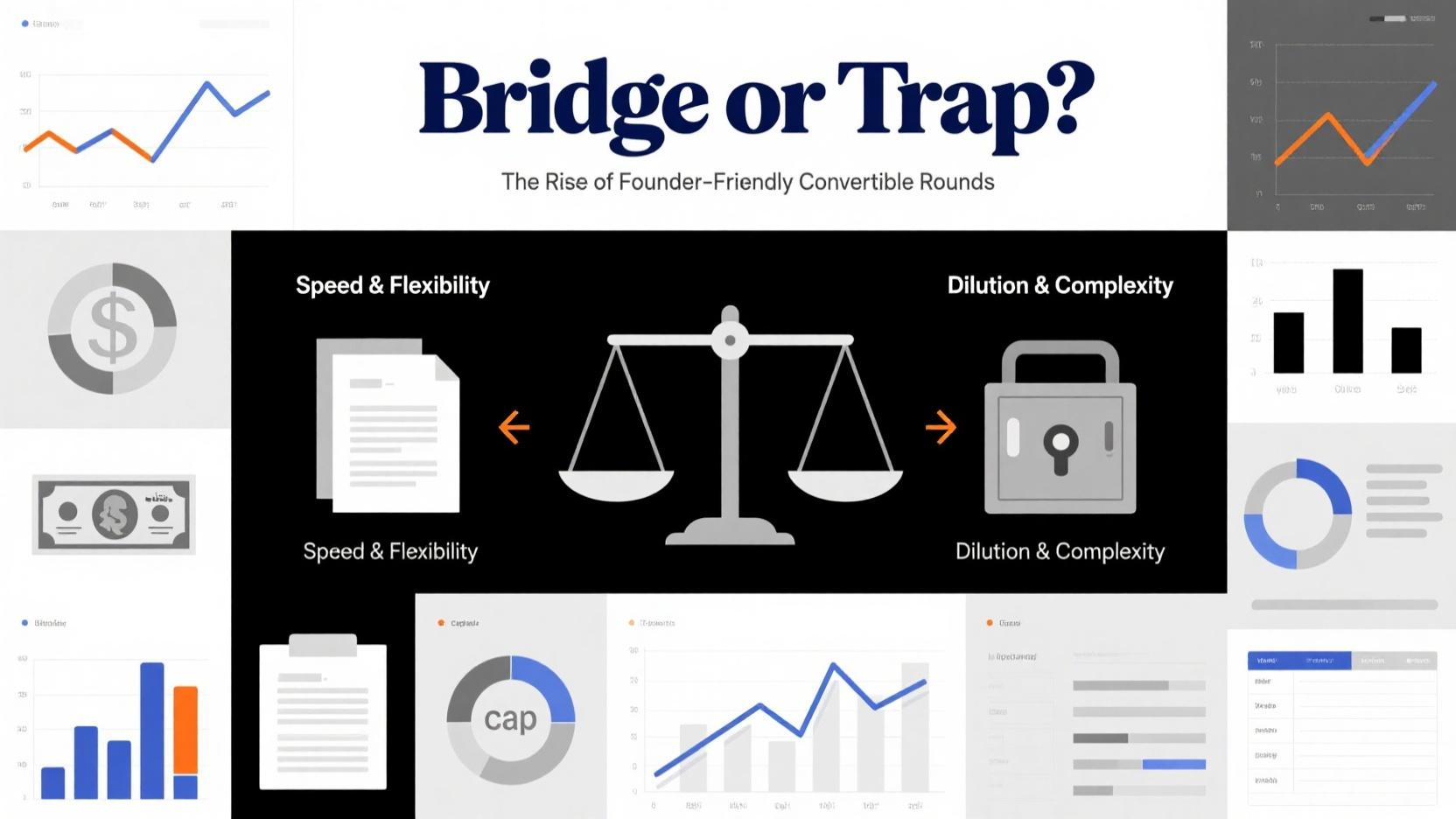

But are these “bridge rounds” truly bridges — or traps in disguise?

The Allure: Speed, Simplicity, and Founder Control

Compared to traditional equity rounds, convertible instruments offer:

Minimal legal complexity

No need to set valuation upfront

Faster closings with fewer negotiations

This makes them especially attractive for:

Solo founders with traction but no legal team

Startups waiting on a product-market fit milestone

Teams needing a quick top-up before a major raise

“We closed $400K in 10 days with a SAFE,” says Ethan Salazar, founder of a Web3 tooling startup. “No board seats, no dilution math—just runway to ship.”

The Risk: Kicking the Can Down the Cap Table

But convertibles aren’t without downside:

Multiple rounds of convertibles can stack discounts and caps dangerously.

Pro rata rights and MFNs (most-favored nation clauses) can dilute founders more than they expect.

Without a clear lead investor, governance and support may be lacking.

In 2024, several AI and climate-tech startups faced unexpected cap table chaos after raising multiple overlapping SAFEs — leading to painful renegotiations during Series A.

Investor Perspectives Are Shifting Too

Savvy angels and early VCs are becoming more cautious:

Requesting data rooms earlier

Pushing for clear valuation caps

Using hybrid instruments like Post-Money SAFEs with MFNs

Meanwhile, newer platforms like Capbase and Pulley are helping founders model dilution scenarios before they commit.

Key Takeaway

Convertibles are powerful tools when used with clarity — but dangerous when used for delay. For founders, the real win is transparency: understanding the tradeoffs, planning for future rounds, and using flexible capital to hit measurable milestones.